If there is one thing I have learned in all these years working in the luxury real estate market in CDMX, it is that pricing a property is an art. And, like any art, it has its share of science, strategy and, above all, reality. No matter how spectacular your Polanco apartment or Bosques residence is, if the price is not in line with the market, the sale is simply not going to happen.

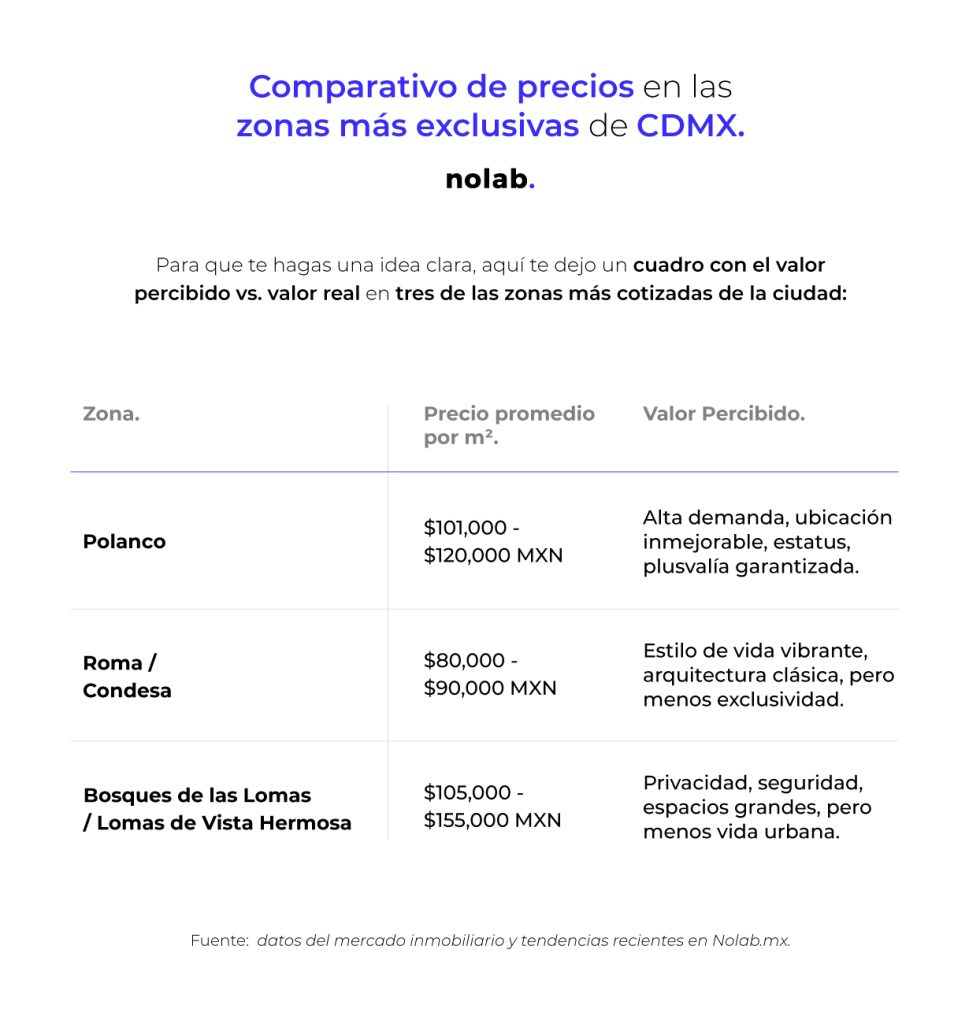

Let’s be clear: the value of your property is not defined by you, not even by the appraiser. It is defined by the market. And this is where many owners and developers go wrong, because they confuse “perceived value” with “real value”.

To illustrate it better, I will tell you a real case: a client in Bosques de las Lomas had a spectacular residence, with imported finishes, exclusive architectural design and a dream garden. His total investment had been 0 million pesos (that’s right, the property was part of an inheritance and his most important patrimony), so naturally he wanted to sell it for at least 55 million pesos because that was the price of similar properties and the reference of his cousin who had sold her parents’ house for a similar price. But here is where reality comes in: the Bosques market was not willing to pay more than 45 million for a 15 year old property like this one, in the same area, no matter how much they invested in its customization (the finishes of the property were divine).

The owner insisted on his price and kept the house listed for almost two years without receiving serious offers. Finally, after much wear and tear, he agreed to sell it for $44 million. The result: waste of time and money, because if he had listed it at the right price from the beginning, he would have sold it much faster and without so much negotiation (Another fact: the first serious offer he received was for 47 MDP but he rejected it waiting for the buyer who could get to 50 MDP and did not want to demolish it).

This story is more common than you think. Many owners think their property is worth more because “it’s special,” but the market doesn’t buy emotion or memories. It buys location, square footage, amenities and demand.

How do you know if you are setting the right price?

- I’m going to be very honest with you: overvaluing your property can be commercial suicide. People who buy in this segment know the market, are well advised and have access to real time comparisons. If your price is inflated, they will notice instantly and simply ignore you.

- Strategies to define the right price

- Do a Comparative Market Analysis (CMA): It is not enough to “believe” that your property is worth a certain amount. You have to compare it with others similar in location, size and characteristics to understand where the market is.

- Understand perceived value vs. real value: A residence with exclusive design, premium location and spectacular amenities may have a higher perceived value. But if the market doesn’t support it, the reality is that no one will pay that extra.

- Think like a buyer, not a seller: The luxury market is aspirational, but also rational. Buyers are looking for exclusivity, but also good value. If they don’t see value in your offer, they will pass you by.

- Leverage data intelligence: At Nolab, we use real-time data to assess trends and adjust strategies. If the market changes, you must change too.

- Consultation with experts: Sometimes, the owner’s ego plays against him. “My property is worth more because I invested in the best finishes.” But if the market isn’t willing to pay for it, it simply won’t sell. Listen to real estate valuation and marketing experts.

How to do an online appraisal (without falling into the neighbor’s trap)

Today, there are online tools that can help you make a realistic estimate of the value of your property. Platforms such as Propiedades.com, Inmuebles24, monopolio.com.mx or Zillow and Idealista (for international references) allow you to compare your property with similar properties in your area. The key is to analyze trends, consult with experts and, above all, not get carried away by unrealistic expectations.

But be careful, this is just a starting point. Just because your neighbor has sold his apartment at twice the average value does not mean that you will be able to do the same. Many times, these cases are exceptional for specific reasons such as inheritances, urgent sales or buyers without market information. In addition, the condition of the property, the orientation, the quality of the finishes and even the time of the year when it is sold can influence the negotiation. It is important to complement any online estimate with a thorough analysis of current market conditions and buyer expectations.

The professional methodology for a valuation

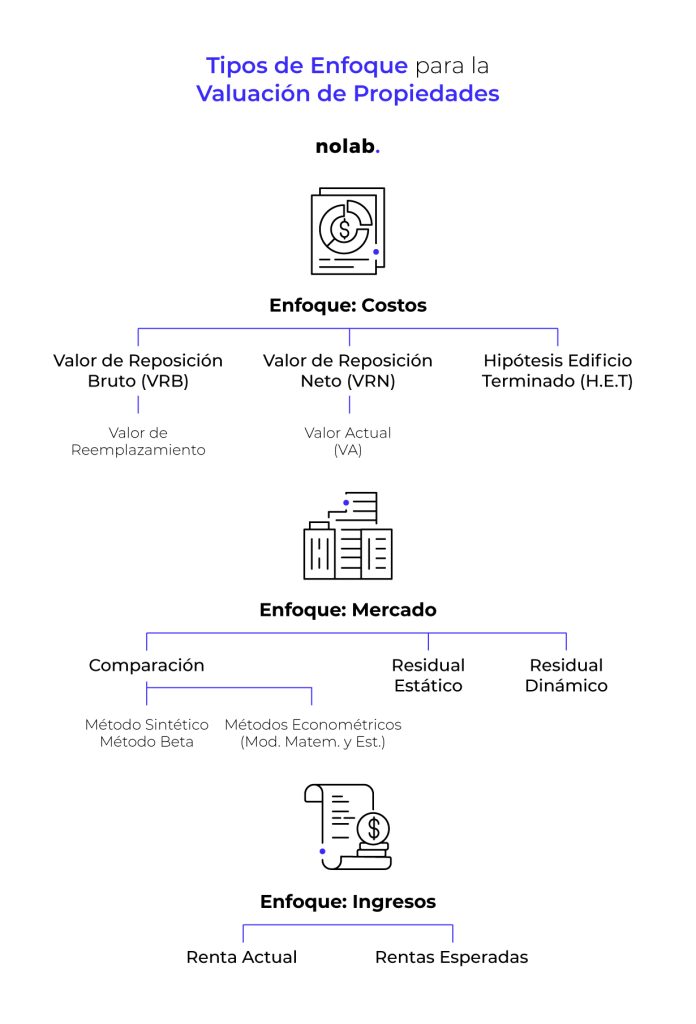

Now if you are looking for a much more complex study on the value of a property according to the rules that professionally govern the guild of expert appraisers in Mexico and as determined by the Federal Mortgage Society, we can base it on 3 fundamental approaches:

Physical Approach: This value approach is based on the principle of substitution, which establishes that no buyer aware of the general characteristics of a good would be willing to pay more for it than it would cost to replace it with another that provides similar or equivalent utility, in other words, that its value will depend on the cost necessary to replace a substitute good of similar characteristics and can be taken relatively easily through a budget.

Market Approach: This approach to value is based on the comparison of similar transactions or properties, establishing the qualitative differences that may exist between them and the subject under analysis, and determining how these influence the value of the property under analysis. One of the most characteristic examples is the used car market, since based on the comparison of known sales and taking into consideration the physical condition of the car we are interested in acquiring, we can, without being professional appraisers, make a reasonable offer to buy it (a bit like what I mentioned at the beginning).

Income capitalization approach: This approach establishes that the value of an asset is equivalent to the present value (at the date on which the appraisal is made) of the future income and benefits that the asset will produce during its useful life of economic production, so we could establish that it is related to the principle of anticipation; and it is also known as the productivity or income capitalization method. It is basically based on a detailed analysis of the capacity of an asset to produce profits, according to the degree of risk that the investment represents in comparison with another possible alternative.

In order to apply these approaches, the methodological processes and the variables that influence each one must be known. In the Physical Approach, the homologation process is used to determine the market value based on similar samples. In the Market and Income Capitalization approaches, the variables and the homologation process are the same, and focus on the homologation of buildings.

Listen to the market and sell faster!

If you really want to sell your property without wasting months (or years) waiting for the “perfect” offer, you need to adjust your expectations to the real market. At Nolab, we help owners and developers make smart decisions based on data and high-impact marketing strategies.

If you talk to me or any of our team we will always go to the most up to date table we have of current market closing prices, which is very relevant as we are not only dedicated to listing properties but we are very close to the sale and negotiation and understand perfectly how each of the areas we work in are being negotiated.

I assure you that if we can adjust your price we will make a perfect match with better qualified clients. Take it into account and let’s have a coffee to talk next time.

If you want a real valuation and a winning sales strategy, schedule a consultation with us. Write me here and we will review it together.

Good sales.

– Gus.

Preguntas frecuentes

El mercado. No el propietario ni el valuador, sino la oferta y demanda real.

Sí, pero si no está alineado con el mercado, difícilmente se venderá.

Si llevas meses sin ofertas serias, probablemente esté fuera de precio.

Cada venta es única. Factores como urgencia, herencias o compradores mal informados pueden influir.

Venderás más rápido, pero es clave no subestimar el valor real. Un análisis de mercado te dará la cifra correcta.

Depende del precio y la estrategia. Si está alineada con el mercado y bien posicionada, puede venderse en semanas.